Loans

Get affordable financing for your ideal space, inventory, and more.

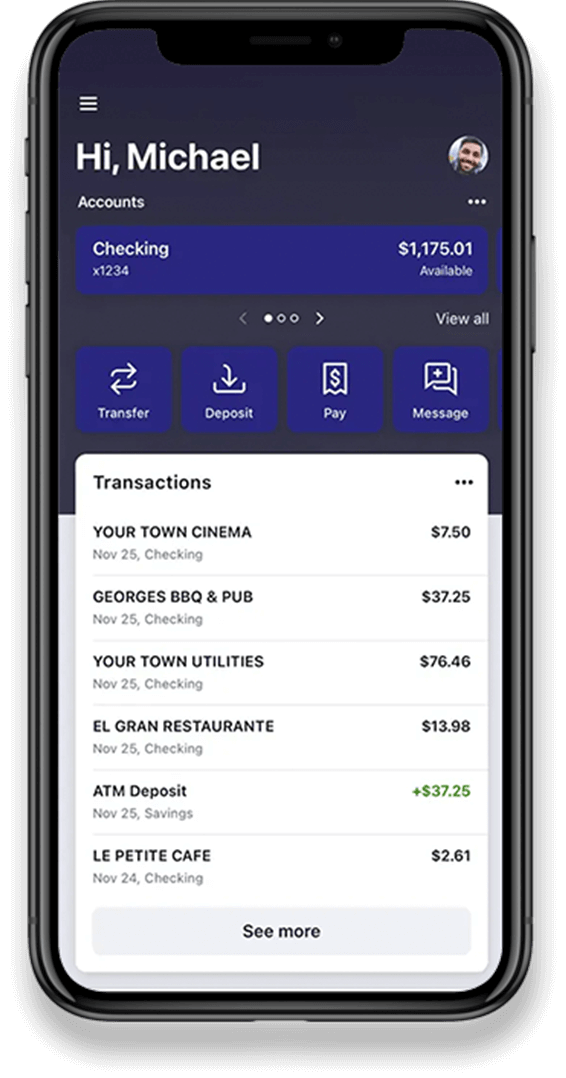

A new website and mobile app is here!

It could be your lucky day, month or year! Someone has to win, and that someone could be you!

Discover the exclusive benefits of our checking for customers age 55 and better. You’ll enjoy discounts and travel opportunities!